For most current version, see My Working Budget.

Nov 19, 2021

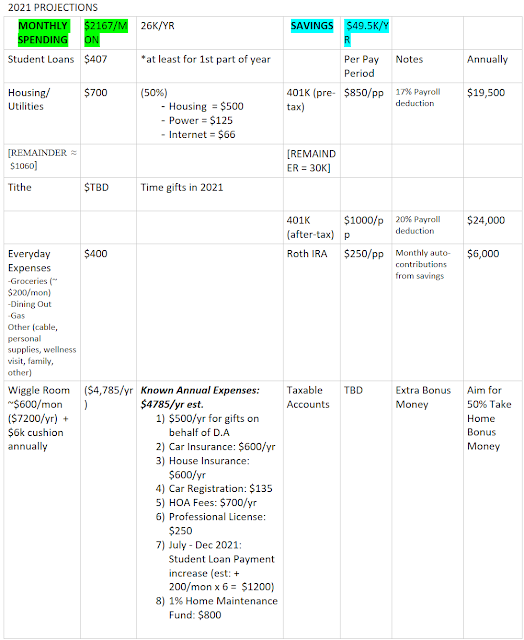

2021 Budget Proposal (last revision date: Nov 2020)

*Blogger stopped allowing me to copy and paste charts, so this is just an image.*

Dec 22, 2020

The Working Budget

last revision date: Feb 15, 2020

GROSS SALARY: | $100,000 | ($48/HR) |

NET SALARY: | $54,000 | (GROSS- 401K – PAYROLL DEDUCTIONS) |

SPENDING TARGET: | $26,000/ yr | ($2,167/MON) |

POST-TAX SAVINGS GOAL: | $26,000/YR | TOTAL = 45.5K = POST-TAX SAVINGS + 401K (45.5K = 26K + 19.5K) |

2020 PROJECTIONS

MONTHLY SPENDING | $2167/MON | 26K/YR | SAVINGS | $45.5K/YR | ||||

Student Loans | $530 | Per Pay Period | Notes | Annually | ||||

Housing/ Utilities | $1,100 | (50%) | 401K | $833/pp | Payroll deduction | $19,500 | ||

[REMAINDER ≈ $537] | [REMAINDER = 26K] | |||||||

Tithe | $137 | |||||||

Everyday Expenses -Groceries (~$200/mon) -Dining Out -Gas Other (cable, personal supplies, wellness visit, family, other) | $400 | Roth IRA | $250/pp | $6,000 | ||||

Wiggle Room 2k, for savings or spending | Taxable account = $20,000 |

Dec 24, 2019

| GROSS SALARY: (yr) | $100,000 | ($48/HR) |

| 401k DEDUCTION | $19,500 | (PRE-TAX) |

| NET SALARY: (yr) | $54,000 | GROSS – 401K -OTHER PAYROLL DEDUCTIONS

Source: SmartAsset

|

| SPENDING TARGET: | $26,000/ yr | ($2,167/MON) |

| POST-TAX SAVINGS TARGET: | $26,000/ YR | |

| TOTAL SAVINGS GOAL: | $45.5K/YR | TOTAL = POST-TAX SAVINGS + 401K

(45.5K = 26K + 19.5K)

Up $500 from 2019

|

| Wiggle Room | 2k | *Can be for extra savings or extra spending |

Dec 7, 2018

2018 Working Budget (last published version; last updated: 03 Mar 2018)

SAVINGS

GOAL: |

$600K

|

OBJECTIVE:

(shooting for the stars)

EARLY

RETIREMENT: $600k

DEFAULT:

($300k, landing in the clouds)

10

YEAR SABBATICAL @ $30K/YR |

GOAL

DATE: |

2028(Labor

Day) |

Age

44 |

GROSS

SALARY: |

$89,440

|

($43/HR)

|

NET

SALARY: |

$67,080

|

(estimated

at 25% TAX RATE) |

SPENDING

BUDGET: |

$2,500/

mon |

($30K/YR)

|

SAVINGS

BUDGET: |

$3,115/

mon total |

(37K/YR)

*Using

the Calculator, this is how much I would need to invest monthly for 10 years with an annual interest rate of 6%. |

MONTHLY SPENDING

|

($2,500/ mon)

|

SAVINGS

|

($37k/yr)

| |||

Student Loans

|

$566

|

Per Pay Period

|

Annually

| |||

Housing, Utilities

|

$1000

|

(40%)

Experts recommend 30% = $750

|

401k

|

$750/pp

|

$18,500

| |

Everyday Exp.

Groceries ($200/mon)

Entertainment

Incidentals

· Gas ($50/mon)

· Phone ($27/mon)

· Other

· Household items ($35/wk?)

· Cable?

|

$540

|

Roth IRA

|

$229/pp

|

$5500

| ||

Tithe

|

$250

|

(10%)

|

Taxable account

|

$563/pp

|

$13,000

| |

Remainder

Unexpected expenses:

· travel

· medical/dental

· car maintenance

· car insurance ($53/mon)

· cable, tv subscription

· home repairs, if applicable

· family needs

|

$144

|

June 26, 2018

Say 5 year sabbatical described below comes to fruition. Then what? With some quick-scratch calculations using the compound interest calculator , at least $90k should be left in 401k which would remain untouched for the 5 year sabbatical (Year 2021-2026). By year 5, should have estimated $125k with $0 in additional contributions and 7% interest. If resume monthly contributions of $3115/mon, estimated FIRE at bare bones budget ($450k) could be achieved after 6 years (Year 2032, age 48). I could potentially FIRE for good. Not really taking into account this monthly contribution would be split across two accounts.

June 19, 2018

So the millennial in me is still trying to escape like TOMORROW.

Yes, 15 to 20 years seems quite doable, and conceivably quite manageable.

Even the 10- 20 year sabbatical in 10 years seemed like an improvement (year 2028). And I just decided on that in Feb/Mar 2018.

But I am really trying to do something now. I tried

even the homeless route, what if I were able to save all my money. Or

move in with someone or get 3 roommates. I really don’t want to lose my

mind on the way to financial freedom. So the best I could come up

with this time is this.

Bare bones budget: 500/500/500 (rent/expenses/other)

Monthly: $1500/mon

Annually: $18,000/ yr

What if I did a 5 year sabbatical at that bare bones budget?

$18,000 x 5 = $90,000

What if I did a 10 year sabbatical at that bare bones budget?

$18,000 x 10 = $180,000

At my current savings of $37,000/year how long would it take me to save:

- $90,000? Well, I’m set to hit that number in investments alone at the end of 2018 (see here)

- $180,000? Well, I’m projected to hit than number in investments alone by the end of 2019

Hmm… is this doable?

The Wrench: Ugh, a chunk of my investments are in my 401k! Now what? A Roth conversion takes at least 5 years to avoid fees.

So I took to my taxable account which holds a general “Build Wealth”

Fund and my Roth IRA. I can withdraw from them, I think, without

penalties and fees.

Current balance (at last check): $25,793

Add in my Current Safety Net Fund: $22,164

Left to raise/save:

- For 5 Year Sabbatical: 90,000 – 25793- 22164 = $42,043

- 90,000 – 22164 = $67,836 amount needed in Brokerage Account for 5 Year Sabbatical (bare-bones budget)

- For 10 Year Sabbatical: 180,000 – 25973-22164 = $131,863

- 180000-22164 = $157,836 amount needed in Brokerage Account for 10 Year Sabbatical (bare-bones budget)

Using the compound interest calculator, with these parameters

Starting balance: $25,793

Interest rate: 7%

Monthly

contribution: $1304/mon ( $458 to Roth IRA + $846 to Build Wealth)

(*Note, this excludes 401k contributions as those will not be accessible

without penalties and fees.)

Time to goal:

- For 5 Year Sabbatical at $90k, Goal to meet: $67,836

- Year 1: $43,246

- Year 2: $61,000

- Year 3: $81,904

- Year 4: $103,285

- Year 5: $126,163

- For 10 Year Sabbatical at $180k

- Too long… (in millennial years)

In other words:

Save: 2018 – 2020

Plan: 2020 – 2021

Free: 2021– 2026

Feb 18, 2018, p.m.

Late in to the evening that Sunday, I again used the Compound Interest and Savings Calculator to play with different scenarios. I started with what was the minimum I could really get by on if my primary focus was just leaving the workplace. I had no big travel plans and I could do without a beautiful house. What would I need just to get me to retirement age of say 65? What could I realistically do in 10 years to accomplish this? I realized that if I were working and saving from age 34 to age 44, that would leave me only to raise money to fund my life from age 45 to 65, which is 20 years, not forever. So at 30k a year, just for 20 years, my new savings goal was $600k. Using the calculator tool, I realized this might be possible with minor tweaking on the original budget!! I was rejuvenated....until Monday.

Feb 18, 2018, a.m.

I had already asked God to bless my budget and I was pleased that putting the original savings budget in place was pretty seamless; the spending budget is another story for another day. I still felt unsettled. How did people do this by their 30s? 40s?

Feb 17, 2018

The Side Hustle Struggle Was Real. I hated going to the part time job. In order to accommodate leaving early on days I had to teach, I had to work late shifts at my full-time job. Including the commute, but not prep time, I was working 50 hour weeks and getting paid for 43 hours. I was not happy. So I tried what the other FIRE bloggers purported: a passive income stream through blogging. As we already learned, that was a bust.

Feb 10, 2018

The sentiment to dream bigger than a 10 year sabbatical in 10 years lingered. The original reason I googled early retirement was to find a way out of the workforce...and fast. There had to be a life-hack to saving/investing to get me where I needed to be for good. Could I beat the 10 year sabbatical in 10 years dream? I used the Compound Interest and Savings Calculator to play with different scenarios.

·

How

long will it actually take me to reach a million dollars?

·

Settings:

initial = $60k,

rate = 6%; guess and check on the years

o Saving 2k/month

(beginner/default): 20 years

o Saving 2.5k/ mon// 30k/ year

(moderate): 17 years

o Saving 3.333k/ mon// 40k/ year (aggressive savings): 15 years

o Conclusion: If I save/invest as a novice

as I've been doing, I'm on track to being retired as a millionaire in 20 years,

by age 54 (year 2038). If I save aggressively for 15 years, I can shave

off a measly 5 years off retirement and possibly my life and retire at age 49

(year 2033).

·

What

amount do I actually need to retire?

·

Settings:

initial = $60k,

rate = 6%;

o On a 27k budget (using the 4%

rule/ 25x annual budget): $675,000

·

How

much would I need to save over 10 years (ideal): $3,589/mon

·

How

much would I need to save over 15 years (aggressive): $1,902/mon

·

How

much would I need to save over 20 years (default): $1,094/mon

o Conclusion: If I save aggressively

($3589/mon = $43,068/yr), I can retire thriftily in 10 years at age 44 (year

2028).

o On a 30k budget (using the 4%

rule/ 25x annual budget): $750,000

·

How

much would I need to save over 10 years (ideal): $4,063/mon

·

How much would I need to save over 15 years

(aggressive): $2,171/mon

·

How

much would I need to save over 20 years (default): $1,264/mon

o Conclusion: If I do some conscious

modest saving, I can probably live a similar lifestyle as I've been doing for

the last 2 years, and retire in a similar fashion in 15 years at age 49 (year

2033).

·

OVERALL

CONCLUSION: If

I save modestly for 15 years, I can enjoy a modest retirement at age 49 in the

year 2033.

Call it the 30-something in me, but age 49 to me is age 50 and age 50 is grouped right along with 50s and 60s. This started to make the whole journey not seem worth it. It made me want to get one of the beautiful townhouses going up around my area for $180,000 (twice my budget for housing) and just work until regular retirement age like everyone else or at least for the 20 more years in the scenarios above. It seemed worth the extra 5 years to live in a beautiful desirable home.

Jan 26, 2018

The sabbatical seemed possible but now that I was aware of the early retirement community, I wanted to see what it would take to get to early retirement.

Could I get there by 40 (in 6 years)? Seemed unlikely.

What if I pinched a few more pennies? I tried that and modified my Savings Budget to 40k and Spending Budget to 27k by utilizing the tax-benefit of maximizing a traditional 401k with my employer. That made me nervous and it felt like I was on a financial diet. As with diets, it made me hunger to spend money. That wouldn't work. I began to get discouraged and I was only 1 month in.

Can I make more money? One of the prominent themes in the aggressive savings facet of early retirement was either spend less or make more. I couldn't figure out a way to spend any less comfortably, so I sought to make more. My current job is pretty easy as far as jobs go and although many complain, I feel I am adequately compensated. Sometime before Christmas a part-time job I had applied for 2 years prior offered me an interview. I did a phone interview and was offered an adjunct position with a local community college coming in at $2,000 for the semester. At the time, it seemed like a God-send.

THE FIRST BUDGET

date: Dec 5, 2017

MONTHLY

SPENDING

|

SAVINGS

|

|||||||

Student Loans

|

$566

|

Per Pay Period

|

Notes

|

Annually

|

||||

Housing, Utilities, i.e.

·

Rent/mortgage

·

Water, power,

internet

·

Property tax,

homeowners insurance, mortgage insurance, if applicable

|

$825

|

(33%)

|

401K

|

$729

|

Payroll deduction

|

$17,500

|

||

Groceries ($200)

Entertainment, Incidentals

to include:

-

Gas

-

Phone

-

Other

-

Household items

|

$600

|

Roth IRA

|

$229

|

$5,500

|

||||

Tithe

|

$250

|

(10%)

|

Taxable account

|

$291

|

$7,000

|

|||

Remainder

Unexpected expenses:

-

travel

-

medical/dental

-

car maintenance

-

car insurance

($53/mon)

-

cable, tv

subscription

-

home repairs, if

applicable

-

family needs

|

$259

|

|||||||

Budgets can be both frustrating and fun...I like your story and your voice. Best of luck on your journey!

ReplyDelete~Seth

Definitely 1 of the 2. Thanks for stopping by Seth! - MERJ

Delete